Make sure to overview the warning indications of incorrect ERC statements, a listing that outlines ways unscrupulous promoters have made use of and why their factors are Mistaken.

Federal government orders that don’t qualify. Some promoters have advised employers they might declare the ERC if any federal government order was set up within their region, even if their functions weren’t impacted or should they chose to suspend their business functions voluntarily.

Promoters might not notify taxpayers that they have to decrease wage deductions claimed on their organization' federal money tax return by the amount of the Employee Retention Credit. This triggers a domino effect of tax difficulties for that business enterprise.

For a reminder, anybody who improperly statements the credit needs to spend it again and should owe penalties and curiosity. The only way to assert the ERC is over a federal employment tax return.

The assert for refund could also be signed by a duly licensed agent with the taxpayer if a sound ability of legal professional has actually been submitted.

If you’re unable to withdraw your assert, you may even now file One more adjusted return if you have to:

The IRS paid out the declare to Organization A in 2024, so Small business A gained the advantage of the ERC but hasn’t solved its overstated wage cost on its revenue tax return.

Get a deep dive to the differences amongst hard cash and credit card ideas, their tax implications, And exactly how they have an effect on employees and businesses.

The adverts have already been around radio, TV and social websites. You might even more info get advertisements that seem like Formal government letters, or texts, email messages and cellular phone calls promoting ERC eligibility.

The IRS discovered that some of the recent early mailings have inadvertently omitted a paragraph highlighting the procedure for submitting an appeal to the IRS or district court, and the company is using actions to ensure this language is mailed to all relevant taxpayers.

The IRS reminds organizations which they could acquire payments for some legitimate tax periods – commonly quarters – whilst we go on to assessment other durations for eligibility. ERC eligibility can vary from just one tax period to another if, such as, federal government orders were being not set up or a business’s gross receipts enhanced.

In case you filed modified returns for more than one tax period of time, you have to Keep to the measures down below for each tax interval that you're requesting a withdrawal.

Pressure to claim the credit because “every small business qualifies” or mainly because a business like yours received the credit. Eligibility for that ERC is intricate and according to each business enterprise’s specifics and situations.

Nonetheless, now that PPP loans have expired and up to date laws permits businesses that been given PPP loans to also file for ERTC, additional firms are applying for the credit. Subsequently, the IRS provides a backlog of requests, which has extended the turnaround time.

Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Suri Cruise Then & Now!

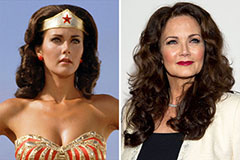

Suri Cruise Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!